Federal Lawmakers Demand Reforms to Government Charge Cards After Casino Expenditures Exposed

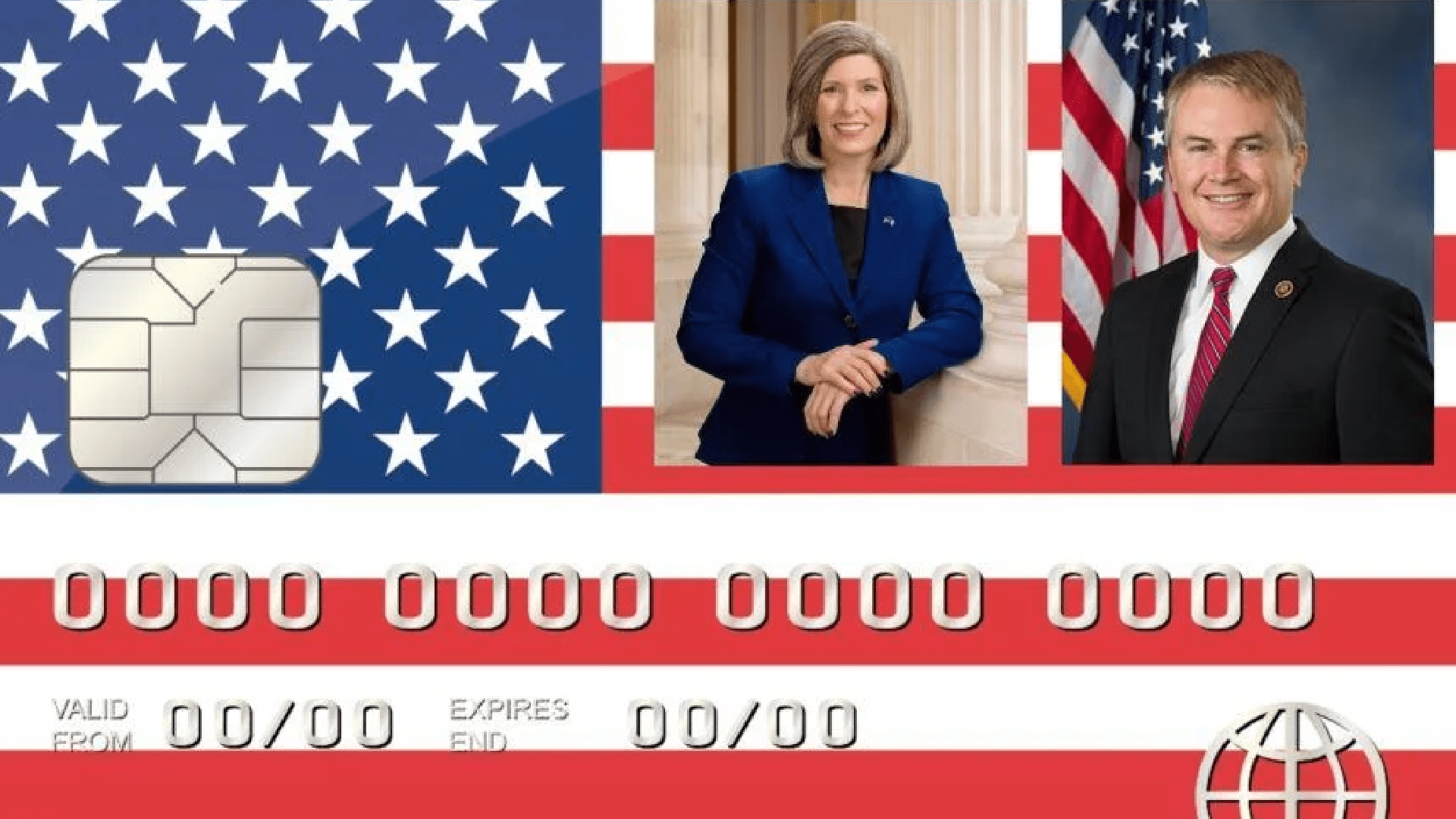

Two Republican federal lawmakers — U.S. Senator Joni Ernst (R-Iowa) and Representative James Comer (R-Kentucky) — are calling for Comptroller General Gene Dodaro’s office to conduct a thorough review of the distribution and oversight of government charge cards. The appeal follows the revelation by DOGE, or the Department of Government Efficiency, that federal charges in the previous year were linked to “high-risk merchants,” such as casino ATMs, strip clubs, and online gaming companies.

In February, DOGE stated that the number of active federal government credit and debit cards exceeds the number of federal employees. In the 2024 fiscal year, about 4.6 million active cards facilitated roughly 90 million distinct transactions, accumulating spending of around $40 billion.

Ernst and Comer, who heads the House Committee on Oversight and Government Reform, contend that there is a significant deficiency in overseeing the expenditures.

Examination Required

In a letter addressed to Dodaro on May 16, Ernst and Comer state that a comprehensive examination of the charge card expenditure programs “is urgently required” to pinpoint systemic risks, eradicate inefficiencies, and reestablish accountability.

“The federal lawmakers wrote, ‘In order to enhance understanding of this issue and guide potential reforms, we ask the Government Accountability Office to carry out an extensive examination of the issuance and management of government purchase, travel, fleet, and integrated charge cards and accounts among federal agencies governed by the Chief Financial Officers Act of 1990.’”

Ernst and Comer reference a report from the Department of Defense (DoD) Office of Inspector General (OIG) which identified 15,610 transactions involving “known high-risk merchants.” They encompassed casino ATMs, dating applications, bars, lounges, strip joints, and nightspots.

“We are skeptical these charges were for legitimate purposes or in service of the DoD’s mission for which the cards were issued,” the lawmakers stated.

"It is indefensible for Department of Defense bureaucrats to waste tax dollars at clubs, casinos, and bars, racking up charges on Super Bowl Sunday, St. Patrick’s Day, Cinco de Mayo, and federal holidays,” said Ernst in separate remarks. “With Washington $36 trillion in debt, the last thing we need is bureaucrats maxing out their tab and sticking taxpayers with the bill.”

Additional high-risk merchant fees were classified for sports wagering, amusement venues, cruise lines, psychic services, golf facilities, country clubs, massage services, cannabis, and vaping merchandise.

Expenditures on Gambling in the Military

In January, Casino.org announced that federal-issued charge cards for military personnel were utilized at casinos, online betting sites, and internet gaming platforms. The audit by the DoD revealed that Defense Department cards were utilized to pay for over $500K in costs associated with gambling, nightlife, and alcohol.

The financial report showed that a service member took out nearly $11K during a trip to MGM National Harbor in Maryland, close to the capital of the nation. The unknown service member conducted 21 ATM withdrawals while on the visit. Cash machines within casinos often charge some of the steepest transaction fees.

“This is not the first report DoD OIG has conducted in recent years, and the problem has not improved. This is because, as the DoD OIG has found, DoD officials have not effectively used policies, procedures, or anti-fraud systems such as the Visa IntelliLink Compliance Management system to effectively identify DoD government travel charge card abuse and fraud,” Ernst and Comer said.